Marketing During an FI Merger or Acquisition.

If you are planning a bank or credit union merger, or if you have one taking place in your footprint market, you have some major marketing opportunities happening over the next year.

As a marketer, the choices become pretty clear if you understand the impact of what is going to take place during a merger. At this point, you have to decide if you are a marketing shepherd or a marketing wolf.

Industry research into the M&A activity of financial institutions is pretty solid and predictable. Depending on your marketing role, you should be strategically planning to manage the best possible outcomes during this merger.

The Reality

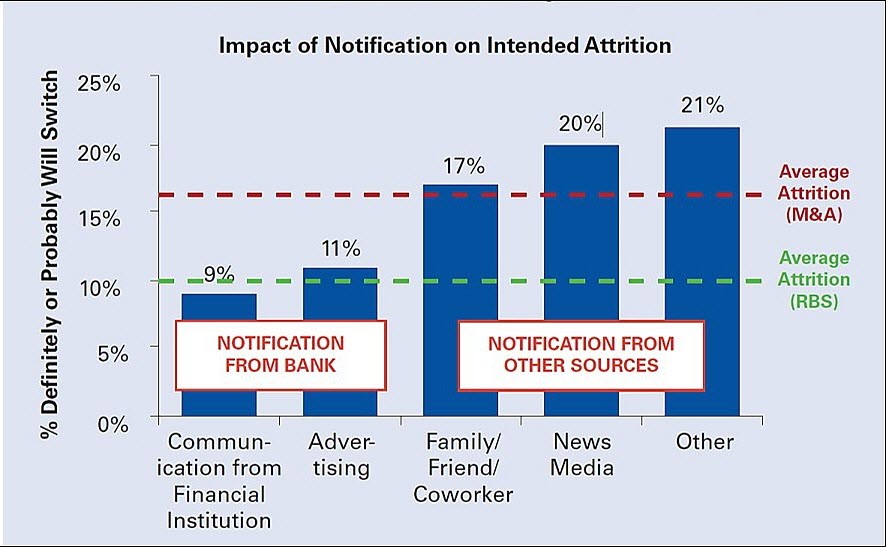

Research conducted by J.D. Powers examined the impact of how the merging banks’ customers react to an acquisition or merger event. The results of the research are extremely clear and predictable within certain parameters. The one fact that we know with certainty is that the two merging entities are going to lose customers. While the chart below might suggest that it is all communications-based, our merger experience shows that communications is only one of the factors that influence the level of attriting customers.

Marketing Shepherd or Marketing Wolf?

As the marketing shepherd, your role is to bring the two flocks together into one new bigger flock, while minimizing the potential loss of customers from either of the two original financial institutions. You are trying to leverage the economies of scale promised to the shareholders that should be created by the merger. But to accomplish this, you must retain as many customers as possible.

Acting as the marketing wolf, you know that on average about 20% of the customers of this merged financial institution will flee the newly formed organization during the first 12 months. Your job is to catch as many of the fleeing customers as you can during that first year. The opportunity to substantially improve your deposit market share is enormous for a very limited time.

Communication of all merger activity is extremely important to being a good marketing shepherd. However, the changes that customers must go through to merge the two FIs into one platform can be a significant factor that influences the rate and speed of customer attrition.

Some of the major factors that cause attrition are driven by customer inconvenience. For example: Changing customer account numbers, changing the online banking platform, the length of time needed to merge the entities to one data platform, the change in products and services, and let’s not forget the change in the fee structure. All these factors and many more play a significant role in the merger attrition rates. Every M&A program is different and must be analyzed to determine the potential loss of customers.

Leap Strategic Marketing has more than 25 years of experience in financial services marketing. Our staff has been through both sides of merger marketing planning, strategy, and tactics. We have managed both the shepherd and wolf marketing strategy roles for our clients.

If you would like to learn more about managing your marketing during a merger, drop us an email or give us a call at 262-436-4080.